Buku is a 2-sided money management app that educates the next generation of investors through fun and interactive activities, while empowering parents to have conversations with their kids about money. Buku’s education platform also extends to parents, offering them help with planning for their college and other savings needs -- providing peace of mind that their kids are building a solid foundation for their financial future.

The Challenge

Early research revealed a disconnect. Kids loved the action of moving money between “spend,” “save,” and “share” buckets, but their enthusiasm faded the moment we introduced concepts like compound interest, diversification, or market risk. Parents wanted to teach these ideas, but struggled to break them down into age-appropriate, engaging explanations.

Our challenge was to create an educational playground for families to teach money management through a connected pool of money by providing entertainment, aspiration, and independence for kids while facilitating oversight from parents.

Our challenge was to create an educational playground for families to teach money management through a connected pool of money by providing entertainment, aspiration, and independence for kids while facilitating oversight from parents.

My Role

As a product designer embedded at Vanguard's Innovation Studio, I helped shape the strategy and execution of Buku across multiple touchpoints. My role touched many aspects of the experience from, mapping parallel journeys for kids and parents, ideating new interaction flows, animation and illustration, defining the product's brand identity, and testing prototypes with real families.

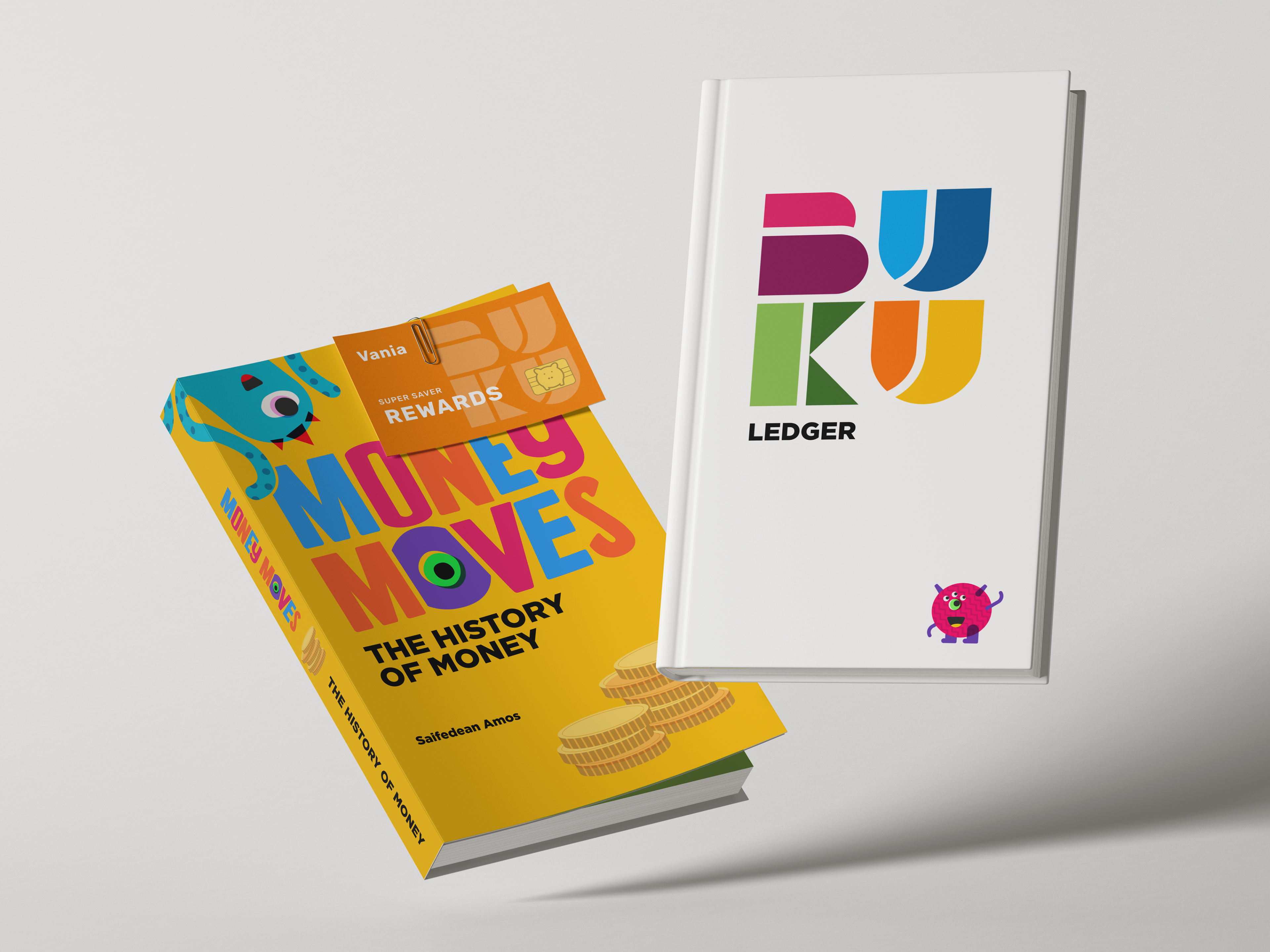

Brand Identity

Research in developmental psychology shows that children often gravitate toward exaggerated, non-human characters because they feel safe to explore big emotions and complex ideas without judgment. By embodying saving, spending, and sharing habits in playful monster personas, the app transformed abstract financial concepts into concrete, relatable stories.

The kids’ experience became a vibrant, character-driven environment where money decisions had immediate, visual impact. Goals were tied to real-world aspirations like a bike, a birthday party, a special gift, and progress was tracked with animated money tree, badges, and celebratory moments. Educational content was integrated into gameplay, like “Kid Boss” challenges that simulated financial decisions and their consequences.

Why “Buku?”

Buku is derived from the french word “beaucoup” meaning “a lot,” as in the phrase “beaucoup bucks.” The name can be extended as a moniker with the experience such as Buku Swag, Buku Rewards, or even “Check your Buku”.

The playful, filled letterforms are inspired by building blocks since this is hopefully the first exposure to money management for many kids as a learning tool. The shapes are intentionally simple, strong, and meant to encourage a little bit of imagination without getting lost.

The playful, filled letterforms are inspired by building blocks since this is hopefully the first exposure to money management for many kids as a learning tool. The shapes are intentionally simple, strong, and meant to encourage a little bit of imagination without getting lost.

Approach

We created journey maps that charted both the kid’s path from earning to investing and the parent’s parallel experience of oversight and support. One insight emerged quickly: kids loved the mechanics of money such as dragging coins into goals, choosing avatars, but disengaged when investment concepts became overly “school-like.”

On the kids’ side, the journey spanned earning money, setting goals, allocating funds, learning investment concepts, and seeing progress. On the parent side, it included onboarding, account management, oversight, and coaching opportunities. This dual-journey map became our product’s backbone, ensuring that features served both audiences in context.

On the kids’ side, the journey spanned earning money, setting goals, allocating funds, learning investment concepts, and seeing progress. On the parent side, it included onboarding, account management, oversight, and coaching opportunities. This dual-journey map became our product’s backbone, ensuring that features served both audiences in context.

Our research also drew from child learning principles such as project-based learning to keep lessons hands-on, choice-driven, and fun. We knew the interface couldn’t feel like schoolwork; it had to feel like an adventure.

Deposit Money

Transfer Money

Withdraw Money

Savings Goals

Investments

Parent App

The parent experience was designed for clarity and quick comprehension. The dashboard displayed account balances, goal progress, and recent activity at a glance, with toast notifications for key events. Prompts encouraged parents to engage in teaching moments, while onboarding flows made adding children and setting up accounts seamless.

Testing & Iteration

We tested prototypes with families over multiple sessions, validating both usability and engagement. Kids gravitated toward money allocation features, and savings goals became a favorite, prompting follow-up questions to parents about investing. Parents appreciated having structured prompts for conversations and a simple way to monitor and guide their children’s progress.

Testing also surfaced refinements: simplifying navigation, clarifying savings vs. investment flows, and adjusting animations for better pacing. These changes were rolled into the design system to maintain consistency as the product evolved.

Outcome

In testing, Buku consistently encouraged kids to choose saving and investing over spending, with most kids wanting to move their funds into long-term savings. Parents reported more frequent and more productive money conversations at home.

The MVP proved that pairing autonomy for kids with guided support from parents created a sustainable learning environment. By making money management tangible, visual, and rewarding, Buku transformed abstract concepts into everyday decisions kids could own.

Reflection

Designing Buku reinforced the idea that real engagement comes from meeting users where they are, and in this case, blending the energy of a game with the fundamentals of financial literacy. We didn’t just simplify investment concepts; we reframed them as challenges kids wanted to take on.

In doing so, we created more than a financial app. We created a shared space for parents and kids to build a lifelong skill together, turning money management from a chore into a choice, and from an abstract idea into a tangible habit.